At Factoring Broker we work with nearly all the UK factoring companies in an effort to bring you the invoice factoring facility that best works for you.

Being totally independent of any lender, means that we can approach a Factoring Company and see whether they are a good match for you.

Factoring companies are no different to other lenders, they sometimes have a change of direction or lending policy which means that one type of business sector they favoured, they’re now not quite so receptive too. This is where our industry knowledge is a great asset for you.

A Guide to Invoice Financing

Welcome to our comprehensive guide on Invoice Finance – a financial solution that can transform the way your business manages cash flow. In this article, we’ll delve into the ins and outs of invoice finance, exploring its benefits, how it works, and why it might be the key to unlocking your business’s financial potential.

Understanding Invoice Finance

Invoice finance, often referred to as “accounts receivable financing,” is a strategic financial tool designed to help businesses manage their cash flow effectively. In simple terms, it involves selling your outstanding invoices to a third-party finance company (known as a factor or lender) at a discounted rate. This enables you to access a significant portion of your unpaid invoices’ value upfront, providing a quick infusion of cash into your business. Other terms for invoice finance include invoice factoring, factoring or debtor factoring.

Key Benefits of Invoice Finance

- Improved Cash Flow: Invoice finance accelerates your cash flow by providing immediate access to funds tied up in unpaid invoices. This liquidity allows you to meet operational expenses, invest in growth opportunities, and navigate financial challenges with ease.

- Enhanced Working Capital: By converting receivables into cash, invoice finance boosts your working capital. This financial flexibility empowers you to take advantage of supplier discounts, negotiate better terms, and strengthen your overall financial position.

- Mitigated Bad Debt Risk: Invoice finance not only speeds up cash flow but also helps mitigate the risk of bad debt. Lenders often assume the responsibility of credit control, ensuring that you are dealing with creditworthy customers and reducing the likelihood of non-payment.

- Streamlined Business Operations: With a steady cash flow, you can focus on core business operations instead of worrying about late payments. This streamlined approach enables you to grow your business, take on new projects, and explore expansion opportunities.

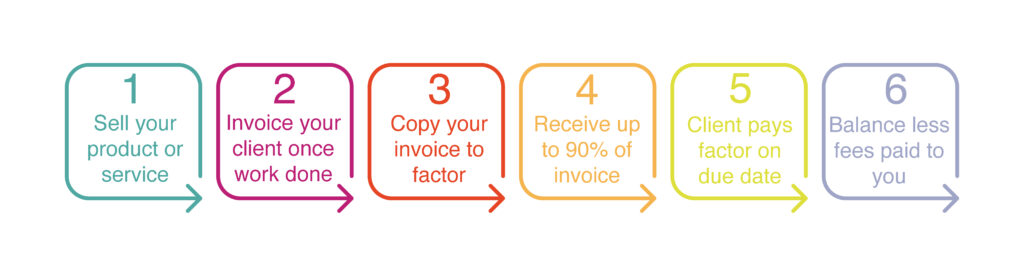

How Invoice Finance Works

- Application Process: To get started with invoice finance, businesses typically apply to a factor or lender. The application process is straightforward, and approval is often based on the creditworthiness of your clients rather than your business’s credit history.

- Invoice Submission: Once approved, you submit your outstanding invoices to the finance company. The factor reviews the invoices and advances a significant percentage of their value to your business, usually within 24 to 48 hours.

- Customer Payment: Your customers continue to pay the invoices directly to the finance company. When they settle the invoice in full, you receive the remaining balance, minus the factor’s fee.

- Ongoing Relationship: Invoice finance can be used on a recurring basis, providing a continuous source of working capital as you generate new invoices. This ongoing relationship ensures a steady cash flow for your business.

Is Invoice Finance Right for You?

Invoice finance is a versatile financial tool suitable for businesses of various sizes and industries. Whether you’re a small business looking to stabilise cash flow or a growing enterprise seeking working capital for expansion, invoice finance could be the solution you’ve been searching for.

Conclusion

In conclusion, understanding and leveraging invoice finance can be a game-changer for your business. By unlocking the cash trapped in your unpaid invoices, you gain the financial freedom to pursue growth opportunities, navigate challenges, and enhance overall operational efficiency. Consider exploring invoice finance as a strategic option to take your business to new heights. If you’re ready to transform your cash flow, delve into the world of invoice finance and unleash the potential within your business.

Using an industry specialist Factoring Broker, like ourselves, can make the whole process so much easier for you as you take advantage of our free service and industry knowledge built up over many years.

Let us help you choose the best factoring company for your requirements.

Contact us today for a no obligation discussion on the benefits of invoice finance.

Factoring Company FAQs

What is a factoring company?

A factoring company buys unpaid invoices from businesses, providing immediate cash flow in exchange for a small fee.

How do factoring companies work in the UK?

UK factoring companies advance funds against unpaid invoices, then collect payment from your clients on your behalf.

What types of factoring are available?

Common types include disclosed factoring, confidential factoring, and CHOCCs (Client Handles Own Credit Control).

How do I choose the right factoring company?

Consider factors like industry expertise, advance rates, fees, contract terms, and customer reviews before choosing a provider. It can be quite daunting so using a factoring broker such as us often saves time and money.

What fees do factoring companies charge?

Fees typically include a service fee (percentage of turnover) and discount charge (interest on funds advanced).

How quickly can I access funds with a factoring company?

Most providers offer funding within 24-48 hours after invoice approval.