Selective Invoice Factoring goes by many names:

- Spot Factoring

- Selective Invoice Finance

- Single Invoice Factoring

- Single Invoice Finance

Whatever name you choose, Selective Invoice Finance basically gives you the option to choose which invoices you submit to the factoring company to be financed.

Advantages of Selective Invoice Factoring

The advantages of this facility are that it may:

Save you money on factoring fees

Only pay for the funding you need, rather than finance all your book debts. Generally the sooner the due date of the invoice, the smaller the fee the factoring company will charge.

Be a solution for a non factorable business

Some businesses are difficult to fund on a traditional factoring facility, due to contract work etc. However, Selective Invoice Finance may be a solution.

Quick and easy to set up

Some facilities can be used on an adhoc basis and may not take so long to arrange. As a result, cash may be released into your business quickly.

However, it’s important to note that most of the time when using single invoice finance, the factoring funder will only be able to fund those invoices which are not yet at due date. It is therefore advisable to contact us in plenty of time of needing the facility.

How Can It Help My Business?

Depending on the lender and their credit criteria, this facility can be very useful for new start businesses. The reason for this is that they have a very limited credit history. Primarily the lender will be looking at the creditworthiness of the debtor when they make their funding decision. They will also take into account how collectable the invoice is eg is there supporting paperwork like a proof of delivery etc.

With the widespread use of online invoice uploading, invoices can be uploaded directly to the lender. They are then able to approve the invoice and make the agreed level of funding available quickly, sometimes within a few hours.

Often there are no long term contracts or long notice periods with these facilities. As a consequence, you are able to make the most of funding opportunities when you need them. However, when the need reduces you will not be tied in.

There’s only a small number of factoring companies who provide Selective Invoice Factoring facilities. We have contacts with the most of these lenders. This allows us to quickly appraise your suitability and introduce you to them.

FAQs for Selective Invoice Factoring

What is Selective Invoice Factoring?

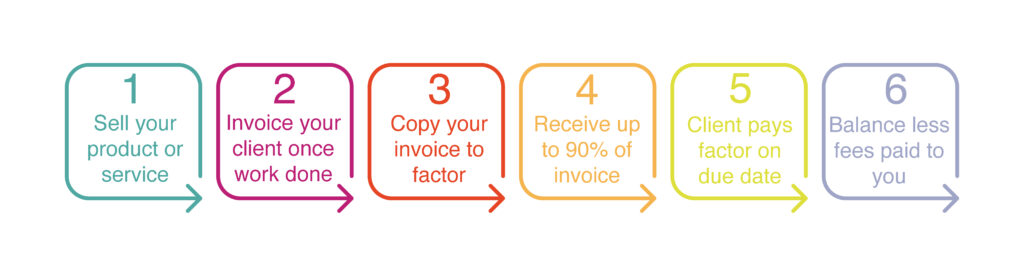

Selective invoice factoring allows businesses to choose individual invoices to sell to a factor rather than the full ledger. It offers flexibility in managing cash flow based on specific needs

How does it differ from full factoring?

With full factoring, all your invoices are sold to the funder. With selective factoring, you retain control of your ledger and choose invoices case-by-case, giving you more autonomy.

What kind of businesses benefit most?

It suits UK SMEs, especially those awaiting payment from major clients or managing seasonal cash flow—any business wanting flexibility without enrolling all invoices. It suits those requiring to use it less frequently.

How quickly do I receive funds?

Once an invoice is submitted, most factors can advance funds within 24–48 hours. At Factoring Broker, we work with providers to ensure fast funding aligned with your needs.

Which invoices can I select?

Typically, you can choose invoices from reliable, creditworthy customers. Factors review each invoice, but the choice remains yours.

Does selective factoring cost more?

Costs depend on the invoice’s size, your customer’s credit score, due time to payment and funding frequency. We’ll help you compare quotes and factor in all fees so you’re never surprised.

Why use a broker like Factoring Broker?

We fast-track your access to multiple UK factors, compare competitive rates, and facilitate terms that suit your business goals—with no fee to you.

To find out whether Selective Invoice Factoring can help improve the cashflow of your business, please get in touch and we will use our panel of factoring firms to match you to a suitable provider.