What is Invoice Discounting?

Invoice Discounting (ID) differs from Factoring. You are responsible for efficient collection of your outstanding invoices, rather than the factoring company. Most lenders will only consider ID facilities for clients who can demonstrate a sound financial standing and efficient credit control.

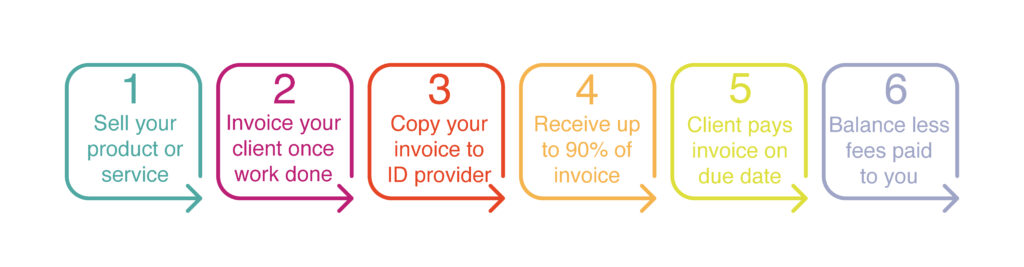

Invoice Discounting is the raising of funds against your debtor book whilst you maintain control of your sales ledger collection. It allows you to maintain collection and relationships with your customers.

Does your business sells on trade credit terms to other businesses? If it does, you may benefit from the advantages of an ID facility. Sales can be either UK or export.

Do you like the confidentiality this facility offers but your business does not quite meet the criteria? Some lenders can operate a Confidential Factoring facility so please ask us about that.

What If My Balance Sheet Isn’t Strong Enough?

Disclosed Invoice Discounting (DID), is ideal for the business who aspires to a Confidential ID Facility (CID) but whose balance sheet isn’t quite so strong.

You can collect your debtor book but the involvement of a funder is disclosed.

It has largely been replaced by CHOCS factoring facilities.

We’ve helped Clients from a wide range of sectors to obtain CID funding. Some lenders will consider a business who is not quite so financially strong for an Invoice Discounting Facility. This is one of the advantages of using a Factoring Broker, we know which lenders will and those who won’t.

Get in touch and let us help you secure the facility for your business

To contact us, please use our Contact Form