What is Factoring?

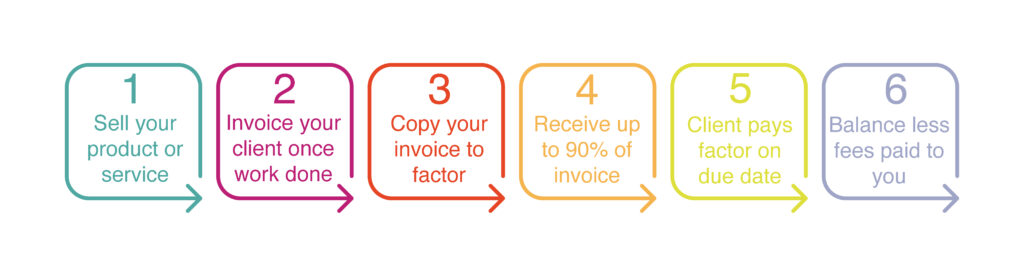

In its simplest form, Factoring is the raising of funds against your debtor book combined with sales ledger management.

Does your London based business sells on trade credit terms to other businesses? You can probably benefit from the advantages of a factoring facility and sales can be either UK or export. We can help you to raise funds against your invoices to improve your cashflow position. By utilising the sales management facility of factoring, you spend less time chasing unpaid invoices. As a result, you spend more time focusing on your business.

Add-ons Available

We don’t just offer a standard factoring solution. You may decide that you would like to take advantage of additional services. These include:

- Insurance – this may be a sensible addition to add peace of mind.

- CHOCS – Customer Handles Own Collections. As the name suggests, this is a hybrid between Factoring and Invoice Discounting. It allows you to handle the collection of your debt. This is most suitable for those who do not quite meet the credit criteria for Invoice Discounting.

- Export Factoring – as the name suggests, this allows for factoring of foreign debt.

Is My London Business Suitable?

We don’t just help established trading businesses. We assist clients in the following situations:

- New Starts

- Low turnover (£50K+)

- CCJs

- Phoenixs

- MBO/MBI

- Construction

- Single debtor

- High concentrations

- Declined by another factor

Industries Suitable

Below is a selection of the business types we have helped secure finance facilities for over the years. This list is not exhaustive. If your business sector is not listed here, please do contact us for guidance.

- Haulage

- Industrial

- Courier and/or Delivery

- Recruitment

- Architect

- Wholesale of Electrical Trade Items

- Wholesale Toy Supplier

- Engineering

- Manufacture

- Construction

Construction Company Factoring

The construction sector has historically been a difficult sector for the factoring companies to fund. Stage payments and the very contractual nature of the industry has made it difficult to easily finance.

Are you a building contractor or sub contractor? If so, you’ve probably been through the pain of speaking to several factoring companies who advertise Construction Industry Factoring. We’re sure that you’ve found the reality is unfortunately as expected.

There is a simple reason for this. Some factoring lenders try to take a standard factoring facility and ‘make’ the construction business fit into the facility.

Obviously, construction contractors and sub-contractors are normally bound by very detailed contracts detailing, amongst other things, stage payments etc.

However, we have a small number of lenders on our panel with specialist knowledge of the construction sector. They view a funding application from a building company very differently to most factoring companies, which is refreshing to see.

The specialist lenders we use often have a base criteria. They usually require the applicant to have been trading for 12 months, preferably with a set of accounts. As a rule, they like the director / owner to be a homeowner. In addition, the lender normally requires sight of any major contracts. This allows them to check for any potential problems and to seek workarounds if appropriate.

We consider ourselves a business partner and are here to help you

To contact us, please use our Contact Form